Photo by Brian Taylor

Among the numerous economic ripple effects of COVID-19 have been disruptions to the partially closed recycling loop of aluminum beverage cans. While Americans continue to drink canned beer and soft drinks even while staying at home more, restrictions on recycling programs have caused fewer of those empty used beverage containers (UBCs) to reenter the aluminum supply chain.

According to an analysis by Platts, republished online by the Hellenic Shipping News, producers of aluminum can sheet in the United States have been importing aluminum from Latin America to help fill the gap created by UBCs not making their way back to secondary smelters.

The analysis notes the average aluminum can is made with 73 percent recycled content. In mid-2020, a combination of strong demand for canned beverages in the U.S. and caution in collecting and sorting by recycling companies and agencies in America has created a temporary wobble in the circular market.

In America’s largest state, California Gov. Gavin Newsom signed an executive order June 22 allowing grocers and retailers to choose if they would like to redeem bottle and cans or continue not to through mid-August. That order has been in place since early March.

In states with deposit-return bottle bills, statistics point to a severe downturn in UBC collections in the late first quarter and in the second quarter of 2020. Scott Breen, the vice president of sustainability with the Washington-based Can Manufacturers Institute (CMI) calculated as of early June that about 70 million cans and bottles had gone unredeemed in Michigan each week it deemed UBC collection as a nonessential activity.

The CMI estimates from 40 to 45 percent of collected UBCs come from the 10 states that have bottle bills, including California and Michigan. Breen says, “At the end of the day we need that material; manufacturers need it.”

On the demand side, meanwhile, a representative from a U.S. can production facility tells Platts demand for canned beverages is “very strong,” adding, “All I know is we’re making every can we can make.”

In the first quarter of 2020, with the epidemic just starting in the U.S., demand for canned beer rose by 6.7 percent and for canned soft drinks by 9.3 percent, according to CMI figures cited by Platts.

In the U.S., just one-quarter of canned beverages are sold in bars or restaurants, with the other three-quarters consumed at home, according to a beer producer Platts quotes. Although the dining-out venue sales have dropped dramatically, sales to the dominant home market have soared. “We are struggling to get cans,” the beer producer tells Platts.

Buyers of aluminum can sheet or the recycled-content ingots used to make it have been turning to Mexico and Brazil for replacement supply. In those markets, according to the can producer interviewed by Platts, demand for cans has dropped because they are used “almost exclusively in bars and restaurants” in two nations where restrictions and public caution have kept such venues empty.

Prices paid for UBCs by can sheet mills rose to 65 percent of the value of primary aluminum in late June, according to Platts, well above what it considers a more “typical” 58 percent figure.

Get curated news on YOUR industry.

Enter your email to receive our newsletters.Latest from Recycling Today

- RMDAS prices portray November stability

- Toyota, GM announce plant investments

- Greenwave reports loss, seeks to maintain Nasdaq listing

- ERI, ReElement Technologies partnership targets rare earth elements

- Aduro Clean Technologies achieves third-party validation for its technology

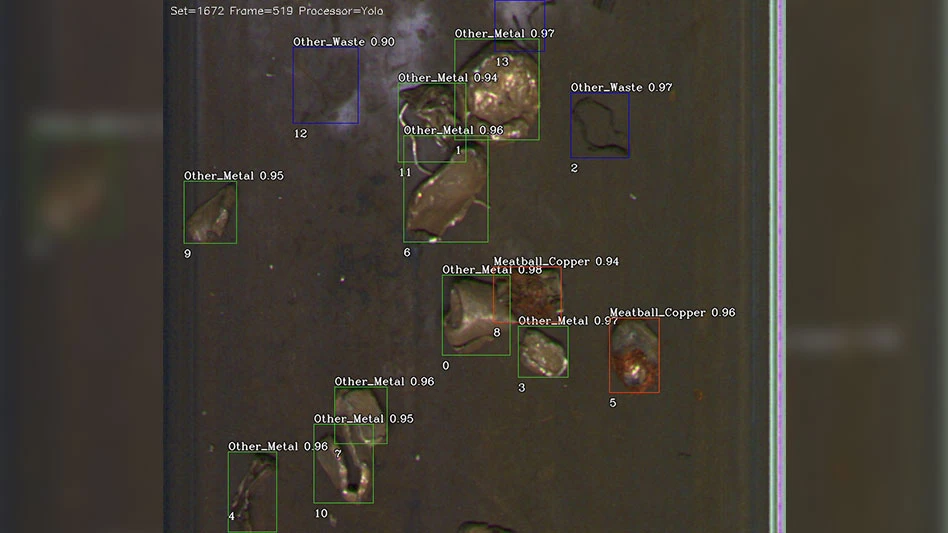

- Sortera Technologies receives funding for Tennessee aluminum sorting facility

- EU official backs aluminum scrap export restrictions

- Midwest freight rail shippers to meet next January