Graphic courtesy of Viridor Ltd.

Viridor Ltd., a waste hauler and recyclables processor based in England, reportedly is being put up for sale by its current owner, New York-based equity fund KKR & Co. Inc.

Bloomberg was the first to report KKR is seeking some $9.4 billion for Viridor and that Hong Kong-based CK Hutchison and London-based Equitix are potential buyers.

KKR purchased Viridor in 2020, acquiring it from United Kingdom-based Pennon Group Plc.

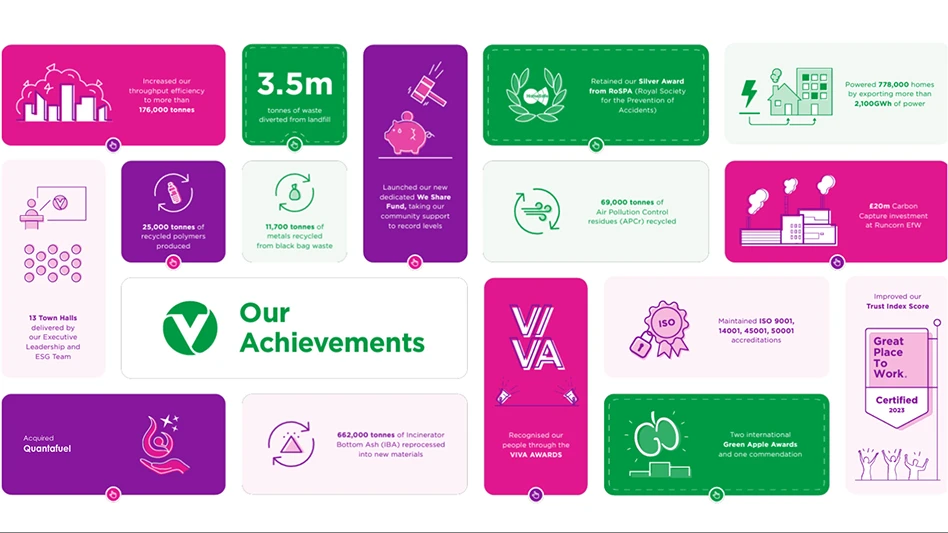

Viridor, whose operations include material recovery facilities (MRFs) throughout the U.K. and a presence in Denmark, claims to have diverted some 3.5 million metric tons of material from landfills annually and has produced about 25,000 metric tons annually of recycled-content plastic.

At the beginning of this month, however, Viridor announced it intended to close a facility in England that helped produce some of that recycled-content plastic, and late last year closed a different one.

Regarding the early August announcement concerning the Viridor plastics recycling location in Rochester, England, Viridor reached an agreement to sell the equipment there, signaling a final closure rather than an idling of the plant.

“This marks the conclusion of Viridor’s strategic review into the site that we first announced in November 2024 in direct response to challenging market conditions for mechanical recycling in the U.K.,” the company says.

As part of that announcement last November, Viridor planned to exit mechanical recycling at its Avonmouth, England, site and conduct a review of plastic recycling operations.

“During this strategic review period for the Rochester site, Viridor tested the market thoroughly but regrettably was unable to find a buyer for the business as a going concern,” the company says.

Viridor says Rochester plant equipment buyer N+P Group, based in the Netherlands, will be looking to relocate the acquired equipment and repurpose it in other U.K. sites, potentially creating jobs in their organization as a result.

As of early this week, there are no announcements on the KKR or Viridor websites regarding a potential sale of the waste and recycling firm.

Latest from Recycling Today

- You have production scrap, WEIMA machinery processes it where it’s made

- CP Group, Cisek Inspections forge innovative X‑ray recycling alliance

- Regroup, CP Group unite for cutting-edge Halifax MRF

- Modern MRFs: AI, automation and safety, redefining recycling operations

- CalRecycle opens comment period on proposed SB 54 revisions

- 2026 Circular Steel Summit: Taking stock of tariffs

- CDRA Conference & Tradeshow 2026: Addressing battery fire risks

- Darda equipment now available in North America