Recycling Today archives

Belgium-based Umicore, whose operations include a recycled-content precious and nonferrous metals smelter in that nation, has reported 2025 financial results that include earnings per share (EPS) by 13 percent and Recycling Group revenue that rose by 5 percent year on year.

Two of the globally active company’s four business units have recycling aspects to them. Its Recycling Business Group is comprised of precious metals refining, jewelry and industrial metals and precious metals production while its Battery Materials Solutions group includes recycling activities tied to lithium-ion batteries, including the production of cobalt and nickel.

Umicore says its Recycling Business Group experienced a “supportive metal price environment” in 2025 and its group revenue of more than $1.1 billion rose by 5 percent compared with 2024.

However, the company says its earnings in the business unit were lower because of “reduced average hedged prices for precious and platinum group metals, a somewhat less favorable supply mix and temporary process inefficiencies.”

Umicore says demand for precious metals in the jewelry and industrial sectors “benefited from strong demand in a context of record high precious metal prices.”

The company says revenue in its Battery Materials Solutions group surpassed $510 million last year, representing an increase of 11 percent compared with 2024. Umicore refers to Battery Recycling Solutions operations within that group has having produced “negative earnings” in 2025, although the level of loss “decreased substantially” compared with 2024.

Regarding the year now underway, Umicore says its Recycling Business Group’s performance is expected to “be supported by a continued favorable metal price environment, provided the current trend persists throughout the year.”

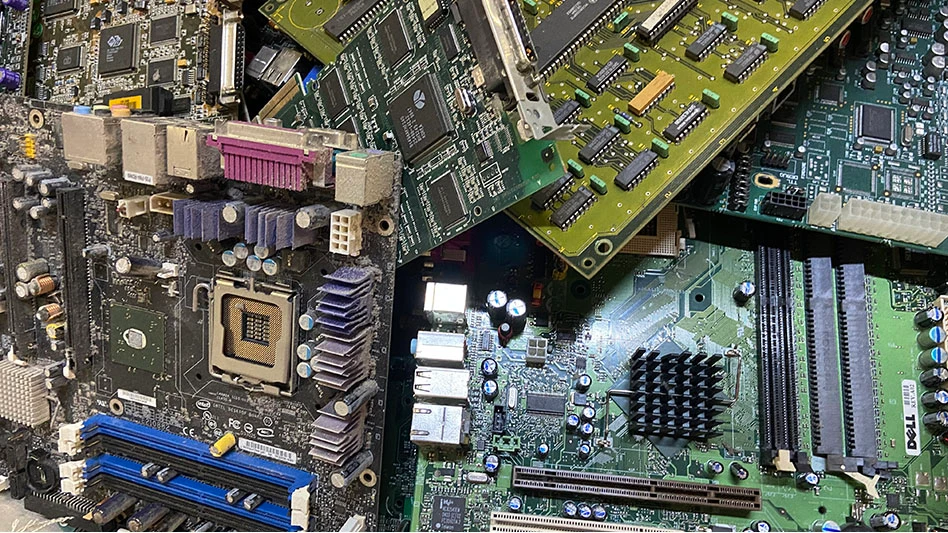

On its website, Umicore says it recovers 17 metals at its smelters and other facilities, including platinum group metals from spent catalysts and a variety of precious and nonferrous metals from electronic scrap.

Adds the company, “Together with ongoing efficiency measures, this should help offset the year‑on‑year impact of lower average hedging prices and [a] scheduled smelter maintenance shutdown.”

Latest from Recycling Today

- QCC torches include customizable features

- Indonesian policy could affect stainless scrap prices

- Casella posts a loss in Q4 2025

- California bill targets recycled content definition

- McNeilus names Haaker Equipment first Dealer Partner of the Year

- NWRA, SWANA issue responses to BLS fatality data

- ReMA board to consider additional nonferrous specification

- Princeton NuEnergy appoints president, chief financial officer