The cross-border trading of ferrous scrap and finished steel is being severely tested by protectionist measures in nations around the world, according to several presenters at the 4th Steel Scrap, Billet & DRI Trade Summit, hosted by SteelMint in Bangkok in late August.

Representatives from Russia and Turkey’s steel industry each portrayed how tariffs and quotas on imported finished and semi-finished steel had impacted their companies.

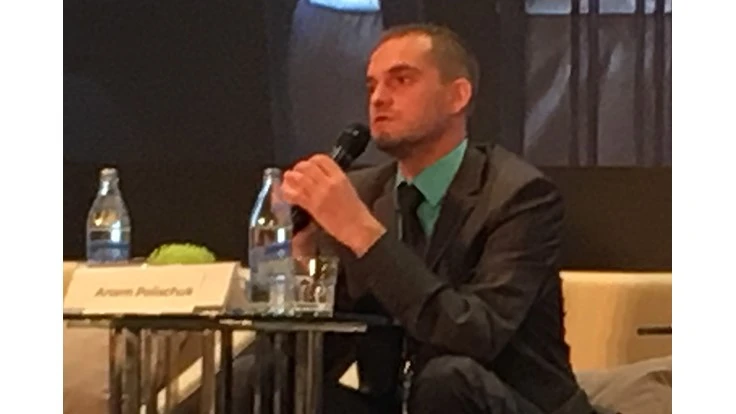

Artem Polischuk of Russia-based steel producer Magnitogorsk Iron & Steel Works (MMK) said in most years from 25 to 30 percent of finished and semi-finished steel is traded across borders, and that MMK (which has mills in Russia and Turkey) has grown accustomed “to exporting steel in such an environment.”

The Russian government is considering a trade barrier of its own in the form severe ferrous scrap export restrictions. Polischuk described that measure as being “in the approval stage.” He said firm domestic scrap demand in Russia had already caused ferrous scrap export levels to drop by about 20 percent in 2019.

Overall the past two years have presented “a lot of barriers,” said Polischuk, describing it as “a difficult time for the global steel trade.”

Finished steel tariffs in the United States and import quotas in Europe have slashed export levels for mills in Turkey, according to Ahmet Kunt of Turkish electric arc furnace (EAF) steelmaker Colakoglu Metalurji A.S.

Sub-par domestic demand combined with the trading barriers has caused Turkey to slip from eighth to ninth place this year on the world’s rankings of steel output, said Kunt. He said he doesn’t “expect any improvement in 2020” for Turkish output if there is “not any change in protectionism.”

Turkey makes 93 percent of its steel via the electric arc furnace (EAF) method, making it the world’s largest importer of ferrous scrap. The market is an important one for United Kingdom-based EMR Ltd., according to Paul Bodkin of that company, who said the U.K. ships some 2.5 million metric tons per year of ferrous scrap to Turkey.

Bodkin said the Turkish market remains important to the U.K., although Turkey has “diversified its imports” of ferrous scrap to include many nations. EMR and other U.K. recyclers, meanwhile, are shipping growing volumes of ferrous scrap to India, Pakistan, Bangladesh and Indonesia.

India’s “scrap gap” could grow to 15 million tons in 2023, said Bodkin, providing one reason why he described the global demand for ferrous scrap as “well underpinned,” with EMR’s likelier challenges occurring if supply becomes “adversely affected” by a slowdown in the U.K. or European economies.

Brexit could present additional challenges for EMR, with nine of the company’s 13 scrap-producing auto shredder yards located in Britain. “EMR wanted to remain; it’s important to be part of Europe,” stated Bodkin, referring to Brexit as “an irritation.”

He said the company’s first duty is to “protect its employees” wherever they are located. Although precisely how freight and logistics will be affected is a “hard issue” to figure out in the shifting Brexit timeline, Bodkin said of EMR, “We continue to invest” to increase the company’s scrap processing capabilities in the U.K. and on the European continent.

As Bodkin spoke in late August, newly installed U.K. Prime Minister Boris Johnson was expressing his determination for the U.K. to leave the European Union on October 31. Just one week later, however, the U.K. Parliament voted to contradict that approach, seeking another delay and a ratified agreement that would prevent a “hard” Brexit.

The SteelMint 4th Steel Scrap, Billet & DRI Trade Summit was August 27-29, 2019, at the Hotel Avani Riverside in Bangkok.

Latest from Recycling Today

- Environmental groups urge Indonesia to return e-scrap shipments

- Foodservice Packaging Institute opens applications for 2026 foam recycling grant program

- Worn Again Technologies unveils Accelerator plant to advance polycotton recycling

- Nashville Waste Services launches new digital route system

- Arconic expands in Iowa

- Cascades invests $6.9M in recycled boxboard plant

- Ocean freight interruptions poised to continue

- Danieli to supply shredder to Australian company