From left: Alter's Daniel Berman, Kripke Enterprise's Chad Kripke and Novelis' Brandon Bice

Among the topics panelists discussed during the session Scrap Signals – Trends in Secondary Aluminum Markets at the S&P Global Energy Aluminum Symposium 2026 were the effects of the Section 232 aluminum tariffs on the scrap market and the aluminum industry’s call for restrictions on high-value scrap exports, with panelists expressing the need for collaboration among scrap processors and consumers to craft effective policy.

Chad Kripke, president of aluminum scrap brokerage firm Kripke Enterprises Inc. (KEI), Toledo, Ohio, said the Trump administration’s enactment of across-the-board Section 232 tariffs on primary aluminum imports of 25 percent in February of last year that increased to 50 percent midyear “brought everything up,” which included the prices of some scrap grades as well as credit risk, the cost of claims and the divergence of spreads.

The escalation in aluminum pricing and the high Midwest Premium, the term that describes the regional price of aluminum in the U.S., which reached $1.03 the week of Feb. 2, resulting from the tariffs, also has affected the approach companies are taking to scrap supply contracts.

Shorter-term contracts

“We get the contracts for a few different reasons,” said Daniel Berman, director of nonferrous marketing for Alter Trading, headquartered in St. Louis. “We have partners such as Novelis and some other people in the room, and they want to be assured of having so much scrap on a monthly basis. … The second reason is because it's easy; you don't need to worry about negotiating every month.”

However, the spread between aluminum scrap pricing and the terminal market price for aluminum has widened considerably throughout 2025 and into 2026, he said, leaving little appetite for establishing year-long supply contracts. Alter is taking a quarterly approach to contracts as a result.

“Obviously, we're all dealing with a lot of volatility over the last couple of years,” said Brandon Bice, senior manager, metal procurement, at Atlanta-based Novelis, a consumer of wrought aluminum scrap. “With the 232 [tariffs] coming in, it changed the markets dramatically,” leading to a later start to the 2026 contract season and prolonged negotiations.

“One of the big differences that we saw this year is, because it moved a little bit slower, we were able to take our time with the conversations that we were having and really understand what our suppliers were worried about and communicate what we were worried about as well,” Bice said, “and then find creative ways to structure the deals that were maybe a little bit different than some of the ways we've historically done it.”

He referred to the change as a “positive paradigm shift” and an approach Novelis could continue using moving forward.

“We were really hard pressed to come up with some really creative solutions,” Kripke said of KEI’s approach to contracting for this year. “It's administratively daunting to try to tailor solutions to everybody's needs.”

Berman said Alter is not interested in creating winners and losers with its supply contracts. “We want a win-win situation with all consumers.”

That’s an outcome KEI also seeks, Kripke said, adding, “I just didn't want to get slaughtered.”

Pricing drivers

Session moderator Sarah Baltic, manager, price reporting, US Nonferrous Metals, at S&P Global Energy, asked the panelists what factor was driving scrap pricing, with Kripke responding that it depends on the application.

“I'm not that big into the secondary world, but I feel like it's kind of just steady, bumping along, no big movements,” he said. “The big movement in the secondary world is probably the rise of the [arbitrage] that was created in toll processing certain grades of scrap into RSI [remelt secondary ingot] to make it into a higher use. The billet market has been challenged this year and has been challenged for quite some time, so that has really affected scrap spreads on extrusion grades. The high-end segregated alloys have done really well; they've tracked decently well with the Midwest. And then some of the postconsumer grades have really been left in the dust.”

“From our perspective, the pricing is really supply and demand driven,” Bice said.

He added that the Midwest Premium has distorted scrap supply. “What we're seeing is the arbitrage window open at a relatively low spread level and pulling in imported material very easily,” which has led to a large supply of scrap available to the consumers in North America.

Baltic noted that more scrap has been entering the U.S. as a result, but a lot of material has been exported as well. “I'm wondering what the trend is going to be this year and how does the proposed legislation on restricting scrap exports factor into that trend?”

She was referring to efforts by the Aluminum Association that would restrict the export of high-grade aluminum scrap from the U.S.

The complexities of scrap export restrictions

“It's a free market,” Berman said. “We have to go where it's best, and consumers will need to raise the prices in order to have that material stay here.”

Kripke agreed.

Bice at Novelis had a different perspective, however. “I know this is a difficult subject, but it's an important one that we need to talk about because I think the world is changing,” he said, referring to similar efforts in other parts of the world, such as Europe and China, to restrict scrap exports.

“I think we need to look at what we're trying to accomplish here with the aluminum industry domestically, and then structure the policy around that,” Bice continued. “And we need to align as an aluminum industry on what those goals are and how we need to approach it because, otherwise, we're going to get left behind” and not have the scrap needed to feed new domestic facilities that are coming online to meet demand for aluminum products.

Berman noted that Novelis has operations around the globe that might struggle to get sufficient scrap material if importing from the U.S. is not an option.

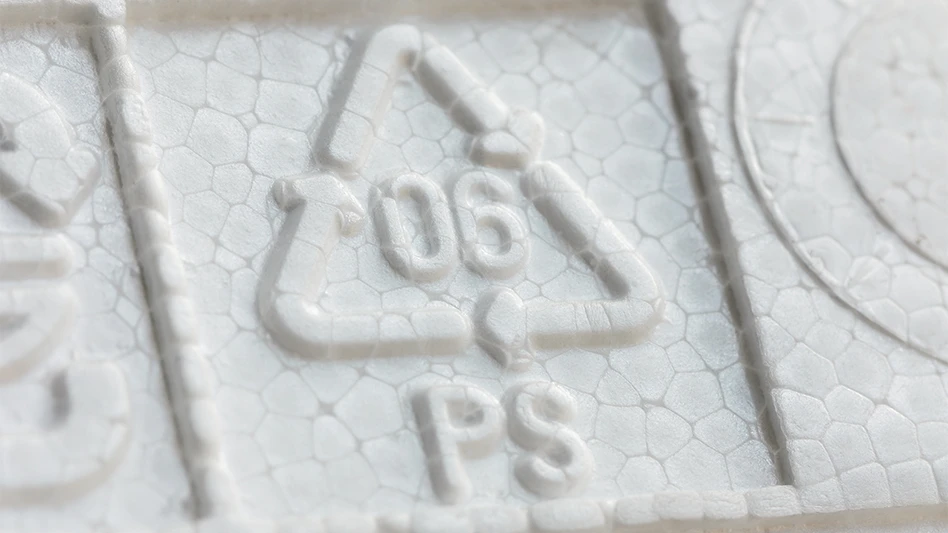

“That's true, but I think what we need to do is break it down in groups,” Bice said, adding that he finds it best to think about three categories of scrap based on supply and demand dynamics. “You can start with UBCs [used beverage cans]. We don't do a great job recycling UBCs here in this country. We have a tremendous amount of demand for that. It's a very easily recyclable product. … We're not exporting a lot of UBCs today anyway. An export ban would not disrupt the recycling industry today, but it could potentially help the aluminum industry in the future. On the far side of the spectrum are the lower -grade products, where there's a huge supply and demand mismatch—twitch, zorba [and] other products. We shouldn't restrict the trade of that; that should be able to go anywhere because if we did restrict it, it would destroy the recycling economics that exist today in our industry.”

“Scrap has gotten a lot of attention. It's become an important part of everything, especially with the tariffs where they're at, especially with energy costs where they're at and the energy savings that are gleaned from [using scrap],” Kripke said, adding that the Aluminum Association’s efforts are “misguided” as stakeholders from the recycling sector were not engaged in the discussion.

While the association has mentioned restricting UBC exports in particular, he said, it is important to understand that the Harmonized System (HS) code for aluminum scrap shipments, HS 7602, has three categories—UBC, turnings and clippings and other—leaving “a lot of gray area and what's coming in and out.” He added that the Aluminum Association is pushing for increased subcategories of the HS code as well.

“They are talking about this in Europe. Because of our high Midwest Premium, we can pretty much name any price we want and pull [scrap] from anywhere in the world,” Kripke said. “That's why the spreads have widened tremendously because there's a whole bunch of imports coming in. But the market here in the U.S., especially in the flat-rolled side, is just not deep enough. It's not deep enough to withstand a shock to something like that. There are times where, and I'm in the market all day, every day, I can't sell a load of something to save my life. … And if, God forbid, there's an impairment with one of these very few players like we saw recently [with Novelis’ Oswego, New York, plant], that's devastating to the aluminum industry as a whole but also to the recycling industry. And if you don't have the underpinning of a global market to bolster the pricing of these things, then where does it all go?”

He also expressed his skepticism that UBCs would be the only grade with restrictions imposed. “We'll let this zorba go. Or maybe we don't because now we're sorting the [wrought aluminum grade] vesper out of it.”

Kripke added that imposing restrictions on scrap exports from the U.S. could put recyclers out of business. “It could drive prices down, and if it did, it would jeopardize the 700,000 tons of imports from Canada and Mexico, and you might end up no better off anyways, and you might actually lose recycled content … because it might go on the landfill. The already poor UBC recycling rate in the U.S. may end up getting worse as a result of lower UBC prices.

“I would love to help craft better policy on it, but I don't think this is the magic bullet,” he concluded.

Bice responded by saying the health of recyclers “is utmost important” to Novelis. “We don't want to disrupt the recycling industry. We can't survive without what you guys do every single day, and we don't want to do something that could unintentionally reduce recycling rates that are already low.”

He acknowledged that the conversation is complex and cannot be resolved with a 20-minute discussion on stage but instead requires involving the whole supply chain to craft effective policy. “Otherwise, we run the risk of the government doing that for us, and then none of us is having a voice,” with the resulting policy disadvantaging everyone involved in the aluminum supply chain. “I think that's where it's the scariest to me.”

The S&P Global Energy Aluminum Symposium was Feb. 1-3 at the Biltmore Hotel Miami in Coral Gables, Florida.

Latest from Recycling Today

- PCA sees improving box demand in latest earnings report

- Graphic Packaging CEO: ‘External environment remains challenged near term’

- Recycling Today Media Group, NWRA launch new Safety First webinar series

- Mueller retains profitability amid copper volatility

- Partnership will explore Great Lakes-river system connections

- Viably adds Maverick Equipment as dealer

- TDS partnership launches compostable tray pilot program at Texas elementary school

- Shapiro Metals appoints chief financial officer