Photo courtesy of Novelis' earnings presentation for the second quarter of its 2026 fiscal year

Novelis Inc., headquartered in Atlanta, has reported its financial results for the second quarter of fiscal year 2026, which included $4.7 billion in net sales, a 10 percent increase compared with the prior-year period.

This gain comes despite a decrease in shipments from 945,000 metric tons in the second quarter of its 2025 fiscal year to 941,000 metric tons as slightly higher automotive and aerospace shipments were offset by lower beverage packaging and specialty shipments. The company attributes the increase in net sales to higher average aluminum prices.

"Our second-quarter financial performance was in line with our expectations for sequential improvement, reflecting solid execution in a continued dynamic environment," Novelis President and CEO Steve Fisher says in a news release accompanying the company’s quarterly financials.

"Demand for infinitely recyclable, lightweight aluminum continues to grow as a fundamental material in modern transportation, building and construction, packaging and other end markets around the world. Our diverse global footprint will be further strengthened with the significant investment we are making in the U.S. to construct a state-of-the-art plant in Bay Minette [Alabama] to bring needed capacity to an undersupplied domestic market."

Quarterly financial highlights

Net income attributable to Novelis’ common shareholder increased 27 percent compared with the prior year to reach $163 million in the second quarter of fiscal 2026. The company attributes this growth to favorable metal price lag resulting from rising average local market aluminum premiums and lower charges associated with the flood at its Sierre, Switzerland, plant, which was partially offset by lower operating performance.

Net income attributable to the company’s common shareholder, excluding special items, decreased 37 percent year over year to $113 million, and adjusted EBITDA (earnings before interest, taxes, depreciation and amortization) decreased 9 percent to $422 million in the second quarter of fiscal 2026. These decreases were primarily driven by a net negative tariff impact and higher aluminum scrap prices, partially offset by higher product pricing and cost efficiency actions, according to Novelis. Adjusted EBITDA per metric ton decreased 8 percent year over year to $448.

In the presentation accompanying its earnings, Novelis notes that scrap prices have been trending stable to favorable in the second quarter of its 2026 fiscal year.

Net cash flow from operating activities totaled $411 million in the first six months of fiscal year 2026, while adjusted free cash flow was an outflow of $499 million compared with the outflow of $345 million in the corresponding period for the previous year as higher capital expenditures were offset in part by net cash flow provided by operating activities. Total capital expenditures increased 27 percent to $913 million for the first six months of the company’s 2026 fiscal year given strategic investments in new rolling and recycling capacity under construction, most notably its greenfield aluminum rolling and recycling plant in Bay Minette.

"We are pleased with the progress we're making in advancing our cost efficiency program to drive better margins in a challenging economic environment," Novelis Executive Vice President and Chief Financial Officer Dev Ahuja says.

In the presentation that accompanied its financial results, Novelis notes that the Bay Minette plant is expected to begin commissioning of its cold mill in the fourth quarter of its 2026 fiscal year, with the plant on track for commissioning in the second half of the 2026 calendar year. Novelis now estimates its total capita cost for this project to be approximately $5 billion.

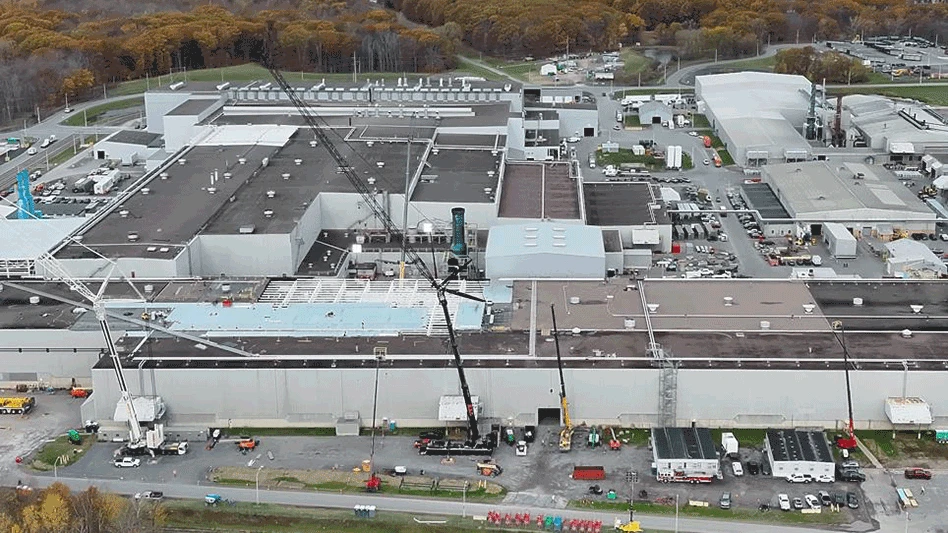

Update on Oswego, New York, plant

The company’s Oswego, New York, plant caught fire Sept. 16. While no one was injured, damage from the fire was localized to the hot mill area and a structure above it. Teams have been working to restore operations quickly and safely while leveraging alternative resources to minimize customer disruption. Based on recent progress, Novelis says it expects to restart the hot mill in December of this year. The company originally targeted the first quarter of 2026 for the restart of its hot mill.

In its presentation, the company notes that the plant is insured for property damage and business interruption losses related to such events, estimating that approximately 70-80 percent of its costs are recoverable through insurance in future periods.

"We are grateful for the swift response and dedication of our teams, as well as the collaboration of our customers, industry peers and equipment suppliers," Fisher says. "Despite this unexpected challenge, we remain confident in the strength of our business, the resilience of our team, and our ability to adapt and recover."

Latest from Recycling Today

- Viably adds Maverick Equipment as dealer

- TDS partnership launches compostable tray pilot program at Texas elementary school

- Shapiro Metals appoints chief financial officer

- Orbis acquires thermoformer Robinson Industries

- PSRA, R3vira partner to expand EPS recycling in Mexico

- PRE tracks plastic recycling technologies in Europe

- Containerboard, boxboard production down in 2025

- VTE names chief commercial officer