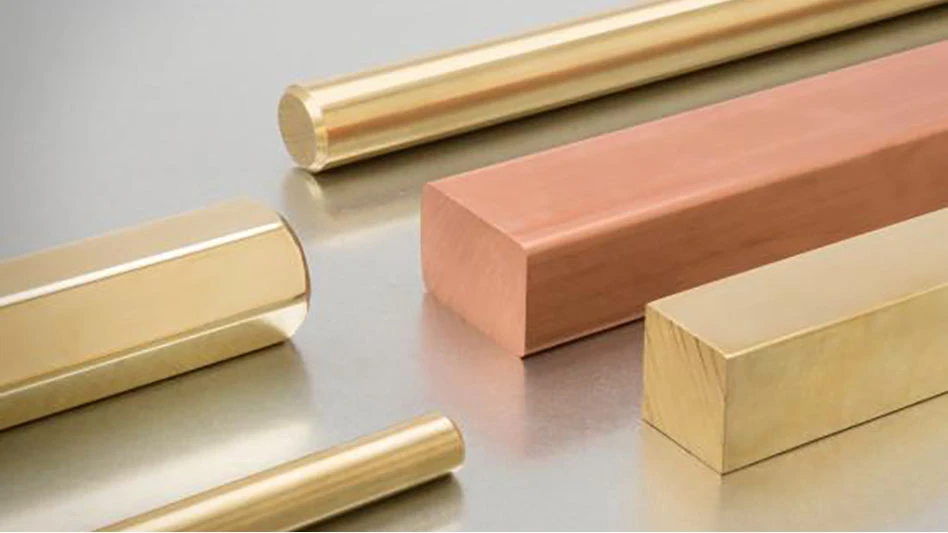

Photo courtesy of Mueller Industries Inc.

Collierville, Tennessee-based Mueller Industries Inc. has reported increased net income in the fourth quarter of last year and for all of 2025.

The company, with operating units that make recycled-content copper and brass, says its net income in the fourth quarter of 2025 increased by more than 11 percent compared with one year earlier, rising from $137.7 million to $153.7 million.

For the full year, Mueller’s 2025 net income reached more than $765 million, representing a 26.5 percent increase from the nearly $605 million it earned in 2024.

Mueller says it could have been even more profitable in its most recent quarter if not for the volatility in copper prices that occurred in late 2025 (and that has reared its head again early this year).

“Gross margin was impacted by an $18.2 million unrealized loss recorded on open hedge contracts, which resulted from the rapid rise in copper prices during the last two weeks of the quarter,” states the company regarding a situation it faced last December.

The company says the price of copper on the Comex exchange averaged $5.13 per pound during last year’s fourth quarter, 22 percent higher compared with one year earlier.

“Our fourth quarter capped a year in which every quarter marked an improvement over the prior year period,” says Mueller CEO Greg Christopher regarding the company’s overall results.

“Those results culminated in the highest annual operating and net income in our company’s history, a particularly noteworthy achievement given that market conditions worsened compared to 2024, not to mention the disruption and costs that tariffs imposed on several of our businesses,” continues Mueller.

The company’s downstream copper and brass products are placed into several end markets, including applications in water oil and gas distribution; heating, ventilation and air conditioning (HVAC); food preservation; energy transmission; and the medical, aerospace and automotive sectors.

“Although we do not expect market conditions to abruptly rebound in 2026, we nonetheless anticipate considerable improvements as the year progresses,” says Christopher.

“This past year, we completed several operational improvement initiatives that will deliver financial benefits in 2026,” he continues. “We have absorbed the impact of changes in tariff and trade policies and will continue to adapt as such policies evolve. Moreover, we continue to have opportunities to invest in and improve each of our business platforms. We have a strong balance sheet, no debt and the necessary capital not only to support these priorities, but also to pursue strategic acquisition opportunities when they arise.”

Mueller operates a recycled-content melt shop and brass alloys production plant in Port Huron, Michigan, and melts copper-bearing scrap at a facility in the United Kingdom.

Latest from Recycling Today

- Partnership will explore Great Lakes-river system connections

- Viably adds Maverick Equipment as dealer

- TDS partnership launches compostable tray pilot program at Texas elementary school

- Shapiro Metals appoints chief financial officer

- Orbis acquires thermoformer Robinson Industries

- PSRA, R3vira partner to expand EPS recycling in Mexico

- PRE tracks plastic recycling technologies in Europe

- Containerboard, boxboard production down in 2025