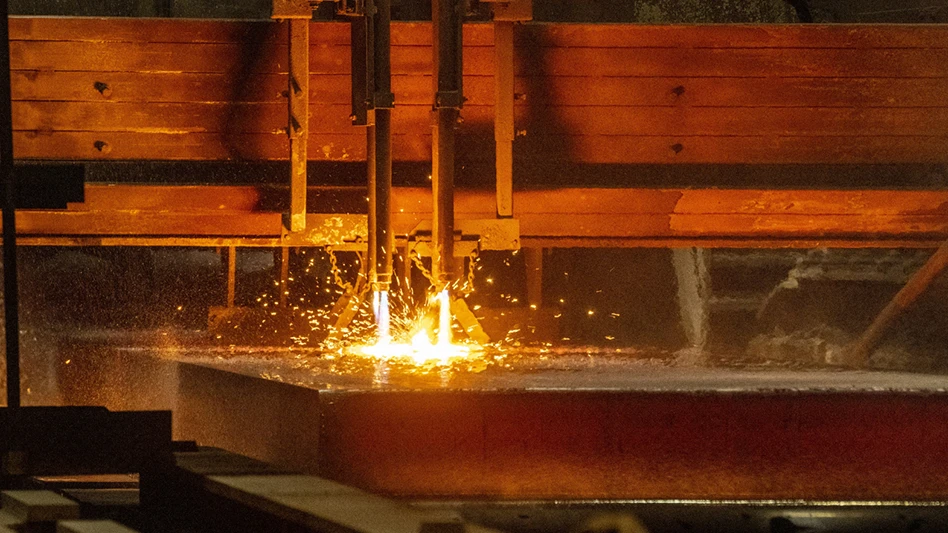

Image courtesy of Li-Cycle Holdings Corp.

A construction project that initially was estimated to cost $485 million and budgeted for $560 million could now cost around $1 billion to complete, according to leadership at Toronto-based Li-Cycle Holdings Corp.

The lithium-ion battery (LIB) recycler, which uses a “spoke and hub” facility model to process end-of-life batteries into black mass at spoke sites and then turn it into battery-grade lithium carbonate, cobalt sulfate, nickel sulfate and other critical materials at a hub site, paused construction on its 41-acre Hub in Rochester, New York, Oct. 23, citing escalating construction costs and the need to conduct a comprehensive review of the project. During its 2023 third-quarter earnings call Nov. 13, the company indicated the review is ongoing but the cost to complete the project likely will fall between $850 million and $1 billion.

RELATED: Li-Cycle pauses Rochester Hub construction

As of the third quarter’s close Sept. 30, $301 million had been spent on construction, according to the earnings report. Upon the project’s pause, Coral Gables, Florida-based contractor MasTec, which was performing the work, laid off 102 nonunion workers at the site, according to a Worker Adjustment and Retraining Notification Act (WARN) notice it filed with the state of New York Oct. 24. The national contractor has a workforce of 22,000 people and specializes in infrastructure construction.

Li-Cycle President and CEO Ajay Kochhar says that along with initiating the project review, Li-Cycle has performed an initial analysis of options for completion of the Rochester Hub and is taking steps to save money, including staffing cuts, implementing working-capital initiatives and eliminating nonessential operational spending. The company also plans to slow black mass production at its other North American Spoke facilities, which include sites in Rochester, Alabama, Arizona and Ontario.

Li-Cycle still is earmarked to receive up to $375 million through a loan from the U.S. Department of Energy (DOE) that was awarded in February but has not yet met all necessary conditions. The company also was approved for $13.5 million in funding through New York State’s Excelsior Jobs Program, but those funds won’t be released until the Rochester Hub meets certain hiring benchmarks outlined by Empire State Development.

Given the sharp increase in construction costs, the company says it will require additional funding before it resumes work on the Rochester Hub, though it didn’t disclose potential sources or an amount.

During the earnings call, Executive Chair Tim Johnston noted the company had sought a refund of $92 million in real estate construction costs from the Rochester Hub’s already-completed $140 million process buildings and warehouse through a building lease arrangement but has since opted not to pursue the refund and is "looking at other options."

Despite the setback, the company maintains that its battery recycling fundamentals remain strong.

“Additionally, we remain actively engaged and continue to work closely with the DOE to satisfy conditions precedent for financial close for the $375 million loan commitment as we complete a comprehensive review of the go-forward strategy for the Rochester Hub,” Kochhar says in the earnings report. “Global EV (electric vehicle) production volumes and battery material demand continues to be underpinned by strong fundamentals. With favorable supply and demand dynamics driving the need for domestic sources of battery material, we continue to see significant benefits for Li-Cycle’s Spoke & Hub network and, in particular, the market need for the Rochester Hub.”

When it announced the project, Li-Cycle said the Hub would be capable of processing up to 35,000 tons of black mass per year and deliver yearly production of up to 8,500 tons of lithium carbonate, 48,000 tons of nickel sulfate and 7,500 tons of cobalt sulfate while creating 270 jobs. The project already has secured several supply agreements for recycled LIB feedstock across the U.S. and Canada.

On the earnings front, the company reported a $130.5 million loss in the third quarter of this year compared with a $20.6 million loss in the same quarter of last year. Its cash-on-hand fell to about $100 million from the $289 million it reported at the end of the second quarter.

In addition, Li-Cycle reports that revenue from product sales and recycling services before noncash fair market value adjustments (FMV) was $4.7 million, down from $4.9 million in the same period of 2022 given lower sales volumes as the company was building inventory for the Rochester Hub and a reduction in the market prices of cobalt and nickel. Total revenues including FMV adjustments were $4.7 million compared with $2.8 million last year and included a noncash FMV impact of nil versus an unfavorable FMV impact of $2.1 million last year.

RELATED: Li-Cycle sets up shop in Germany

Li-Cycle’s operating expenses increased to $144.8 million versus $41.9 million in the third quarter of 2022, driven primarily by the noncash Rochester Hub impairment charge, higher personnel costs, plant facility expenses and research and development (R&D) expenses. The company says this was partially offset by a reduction in raw materials and supplies expenses driven by lower provision for inventory as a result of lower battery inventories on hand.

Its adjusted earnings before interest, taxes, depreciation and amortization (EBITDA) loss was $38.9 million compared with a loss of $35.1 million in the third quarter of 2022, which it attributes to higher expenses relating to the expansion of its global network, “which more than offset increased revenue.” Additionally, it says noncash share-based compensation decreased to $3.8 million from $4 million in the same period of 2022.

Get curated news on YOUR industry.

Enter your email to receive our newsletters.

Latest from Recycling Today

- NDA unveils workforce toolbox

- Ineos Styrolution launches sour cream cups made with recycled PS

- Lacerta products receive PCR certification

- Trash Pandas Utah launches dumpster rental service

- Vesper added to ReMA’s ISRI Specifications

- Comstock purchases equipment for commercial-scale solar panel recycling site

- LKQ to sell its self-service segment

- BMRA: Potential recovered steel export restrictions risk collapsing UK metals recycling industry