Recycling Today archives

Global metals producer Korea Zinc has announced its intention to work in cooperation with the Department of Commerce and the Department of Defense to build a $7.4 billion smelting facility in Tennessee.

Seoul-based Korea Zinc has existing assets in the U.S., including an existing smelter in Tennessee, a majority stake in New York-based electronics recycling firm PedalPoint (formerly Igneo) Technologies and ownership of nonferrous recycling and trading company Kataman Metals, St. Louis.

The announcement comes while Korea Zinc is in the midst of a corporate boardroom and shareholder power struggle involving lawsuits filed by shareholders who wish to undertake leadership changes at the company.

The current leaders of Korea Zinc in the meantime have entered into a partnership with the two U.S. cabinet level departments to invest in the construction of a large-scale smelter in Clarksville, Tennessee.

“As geopolitical competition over natural resources intensifies globally and certain countries increasingly exert influence over critical mineral supply chains, the project is expected to strengthen U.S.-Republic of Korea (South Korea) economic security cooperation while contributing significantly to global supply chain diversification," Korea Zinc says.

The company foresees annual production capacity in Clarksville of 540,000 combined tons annually of 13 different nonferrous metals, and says the proposed facility will be modeled after its existing Onsan smelter in South Korea.

On its website, Korea Zinc describes the Onsan complex as the world’s largest single-site smelter.

“It has secured advanced technology to process complex raw materials, such as low-grade concentrates and scrap with high impurity levels, and has established integrated zinc-lead-copper processes to maximize valuable metal recovery rates, demonstrating global competitiveness,” the company says.

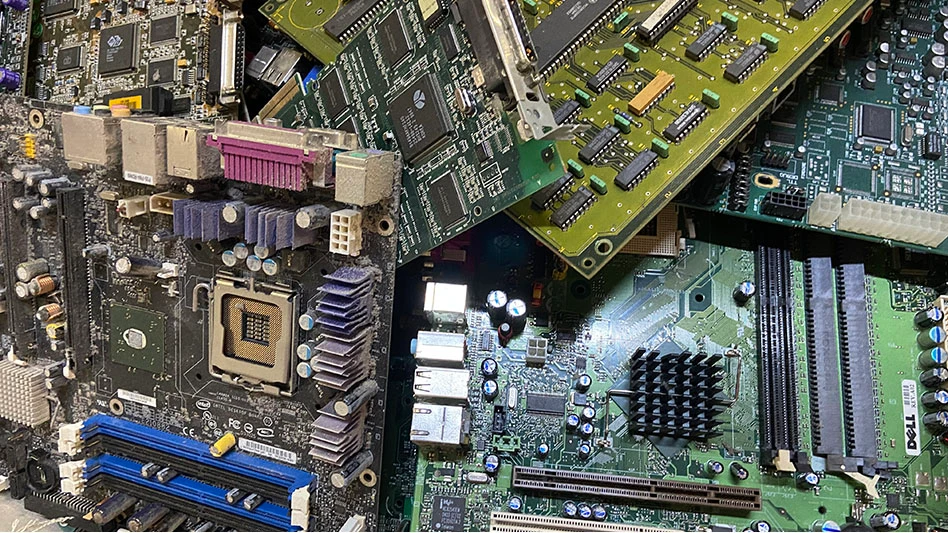

The scrap includes printed circuit boards and other forms of electronic scrap that contain precious metals, nonferrous metals and rare earth elements (REEs).

The 13 metals planned for production at the Tennessee facility include zinc, lead, copper, gold, silver, antimony, indium, bismuth, tellurium, cadmium, palladium, gallium and germanium.

Korea Zinc expects construction to begin in 2026, with full-scale construction to begin in 2027 followed by phased commercial operations starting in 2029. The company estimates the sprawling complex will occupy approximately 160 acres (650,000 square meters) and will be built on the site of its current Nyrstar zinc concentrates smelter in Clarksville.

“Korea Zinc’s critical minerals project in Tennessee is a transformational deal for America,” Commerce Secretary Howard Lutnick says. “Our country will now produce, in volume, 13 critical and strategic minerals that are vital to aerospace and defense, semiconductors, artificial intelligence, quantum computing, autos, industrials and national security.”

While the company’s announcement refers to recycled content as feedstock for the smelter, a separate news release from the Tennessee Department of Economic and Community Development (TNECD) refers to a closed zinc mine in that state that could be reopened in a related move.

In Gordonsville, Tennessee, the company plans to reopen a former mine, bringing back lost jobs and industry to the community, according to the agency.

“President Trump has directed his administration to prioritize critical minerals as essential to America’s defense and economic security,” Deputy Secretary of War Steve Feinberg adds. “The Department of War’s conditional investment of $1.4 billion to build the first U.S.-based zinc smelter and critical minerals processing facility since the 1970s reverses 50 years of industrial decline.”

Korea Zinc board chair Yun B Choi adds, “With its project in the U.S., Korea Zinc will solidify its position as a strategic partner supplying essential minerals for aerospace and defense. This will become a model case of strengthened U.S.-ROK economic security cooperation. Given the current geopolitical climate and strong U.S. support, now is the optimal moment for expansion into the American market.”

Latest from Recycling Today

- NAW secures injunction blocking enforcement of Oregon’s EPR law

- WM opens 2 new MRFs in Ontario

- International Paper to close Washington box plant

- Cascades exits honeycomb packaging, partition business segments

- Customer focus drives Bantam Materials’ success

- ATI reports slimmer profits

- Papilo acquires Allwood Recycling in UK

- RecycleNation helps people find nearby recycling facilities