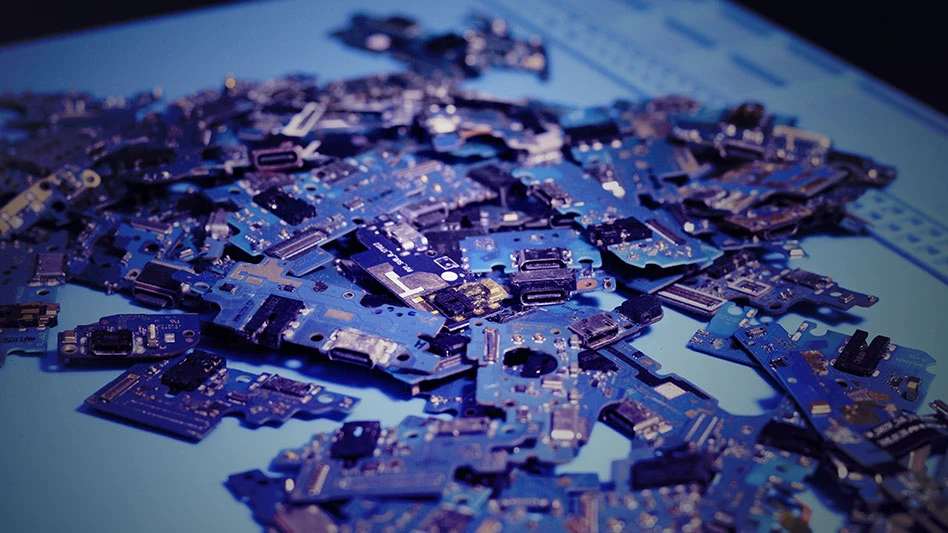

Photo courtesy of Aurubis AG

Late September brought good and bad news for recyclers of nonferrous metals in terms of consuming facility activity.

Germany-based Aurubis AG announced in late September that the melt shop at its Aurubis Richmond facility in Augusta, Georgia, started producing recycled-content nonferrous metals.

Aurubis calls this site the first multimetal recycling plant in the U.S., “strengthening Western supply chains for copper, nickel, tin and precious metals.”

Aurubis CEO Toralf Haag says, “We will continue expanding our wide expertise in producing key strategic raw materials here. With the high availability of recycling material and good local conditions, the American market offers Aurubis appealing prospects that we will continue to consider closely in the future as well.”

The company says demand for strategic metals such as copper is rising steadily worldwide and that U.S. industry alone currently needs about 1.8 million tons of copper per year.

Aurubis Richmond can help meet some of that demand as the plant has been designed to process up to 180,000 tons of end-of-life materials annually, including printed circuit boards and copper wire and cable, recovering several nonferrous metals.

In his report for the “World Mirror: Non-Ferrous Metals,” released by the Brussels-based Bureau of International Recycling in October, Rick Dobkin of Shapiro Metals in St. Louis writes that Aurubis Richmond is a “addition to the U.S. market” that “will hopefully boost domestic recycling of more complex materials.”

The aluminum sector took a hit, however, in the form of a fire Sept. 16 at Novelis’ Oswego, New York, plant. Novelis says it is working around the clock to restore the plant to full operation as safely and quickly as possible. As of mid-October, the company expects the hot mill to be operating early in the first quarter of 2026.

In the meantime, Novelis says it has tapped into its global network of plants and partnered with industry peers to source material to help mitigate the gap in supply, which could affect the supply of auto body and can sheet to the domestic market.

Dobkin describes secondary aluminum prices as stable, adding that scrap pricing is “flat to slightly higher when compared to our previous report in July.”

“The U.S. all-in price for primary aluminum is still elevated owing to Section 232 tariffs on aluminum products, with the regional premium currently in the $1,600 per [metric ton] range,” he writes. “Our elevated primary price had attracted significant amounts of recycled aluminum, which filled the mills and allowed consumers to significantly widen their spreads and drop out of the spot markets.”

Sebastien Perron of CNA Metals Ltd., Stafford, Texas, also writing in the “World Mirror,” notes that Canada is the world’s fourth-largest producer of primary aluminum behind China, India and Russia. “Unusual dynamics have unfolded owing to tariffs imposed by the USA whereby sellers of high-grade recycled materials are fetching a premium to primary metal. The dynamic is driven by recycled materials crossing the southern border to the USA tariff-free into a seemingly distorted market from the Midwest Transaction Premium’s arbitrage over the LME benchmark.”

In Mexico, Alejandro Jaramillo of Glorem SC notes, “Demand for clean mill-grade scrap is balanced mainly because domestic casthouses have cut output and turned to cheaper imported billet and slab instead of melting scrap. At the same time, a strong U.S. appetite is pulling much of Mexico’s mill-grade scrap north. These exports are effectively offsetting reduced local usage, keeping the market in equilibrium for now.”

He also says high-silicon scrap and alloy ingot prices have surged in the secondary aluminum market. “A shortfall at a major smelter left end-users scrambling for alloy ingot, forcing them to seek extra supply from competitors. Those suppliers responded by paying up for scrap and charging premiums for the additional volume. This scramble has driven scrap costs higher and forced buyers to pay more to keep their furnaces fed.”

Regarding the red metal sector in the U.S., Dobkin says that as the arbitrage between the Comex and London Metal Exchange copper contracts lessens, domestic copper spreads have come back to normal, with the market appearing to be in balance.

Latest from Recycling Today

- Viably adds Maverick Equipment as dealer

- TDS partnership launches compostable tray pilot program at Texas elementary school

- Shapiro Metals appoints chief financial officer

- Orbis acquires thermoformer Robinson Industries

- PSRA, R3vira partner to expand EPS recycling in Mexico

- PRE tracks plastic recycling technologies in Europe

- Containerboard, boxboard production down in 2025

- VTE names chief commercial officer