Graphic courtesy of Electra Battery Materials Corp.

Toronto-based Electra Battery Materials Corp. says its previously announced brokered private placement financing offering now is fully subscribed, with investor orders totaling $30 million.

Electra says it received “strong participation” from both existing shareholders and new institutional investors.

“We are grateful for the strong support of our shareholders and encouraged by the confidence shown by new institutional investors participating in this financing,” Electra CEO Trent Mell says.

“This comes at a pivotal moment for Electra, as we move toward commissioning North America’s first cobalt sulfate refinery. With a strengthened board of directors and a favorable policy environment supporting critical minerals development, we are well positioned to deliver long-term value for shareholders and play a meaningful role in the clean energy transition.”

Electra's offering is being conducted with Cantor Fitzgerald Canada Corp. and ECM Capital Advisors Ltd. acting as co-lead agents.

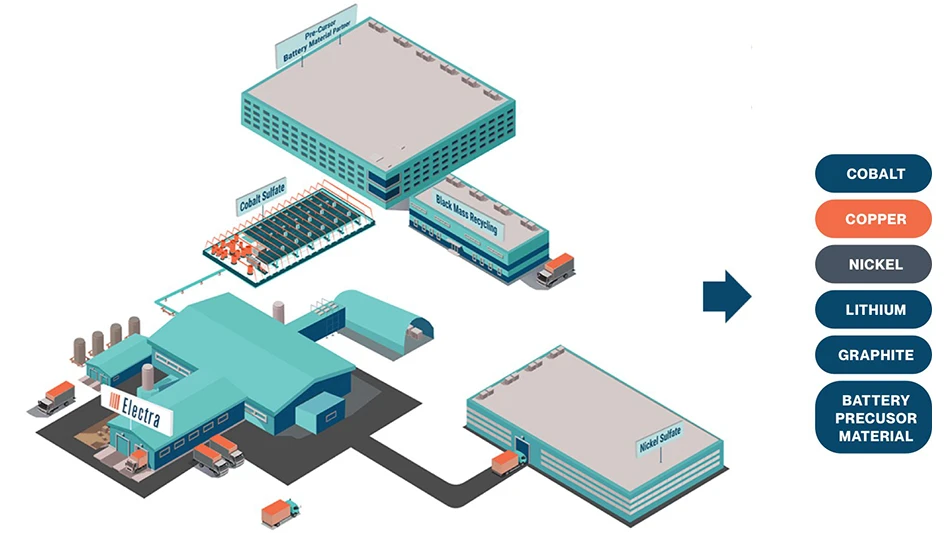

The funding will go in part toward the commissioning of what Electra calls North America’s first battery-grade cobalt sulfate refinery, located in Temiskaming Shores, Ontario.

Electra's strategy also includes nickel refining and battery recycling, with the firm having conducted a feasibility study on that front.

Other projects being explored involves integrating black mass processing and recycling at Electra’s existing refining complex, evaluating opportunities for cobalt production in Bécancour, Quebec, and exploring nickel sulfate production potential in North America.

Latest from Recycling Today

- U.S. Aluminum Co. explores aluminum fabrication plant in Oklahoma

- Sonoco completes portfolio transformation

- Eriez Shred1 data demonstrates scalable copper control

- RCI selects CurbWaste as exclusive operational management platform

- Updated: Supreme Court strikes down IEEPA tariffs

- Recycling Today Media Group launches Scrap Expo Lunch & Learn Webinar Series

- LyondellBasell scales back recycling target

- Former Liberty UK mills eyed by 3 suitors