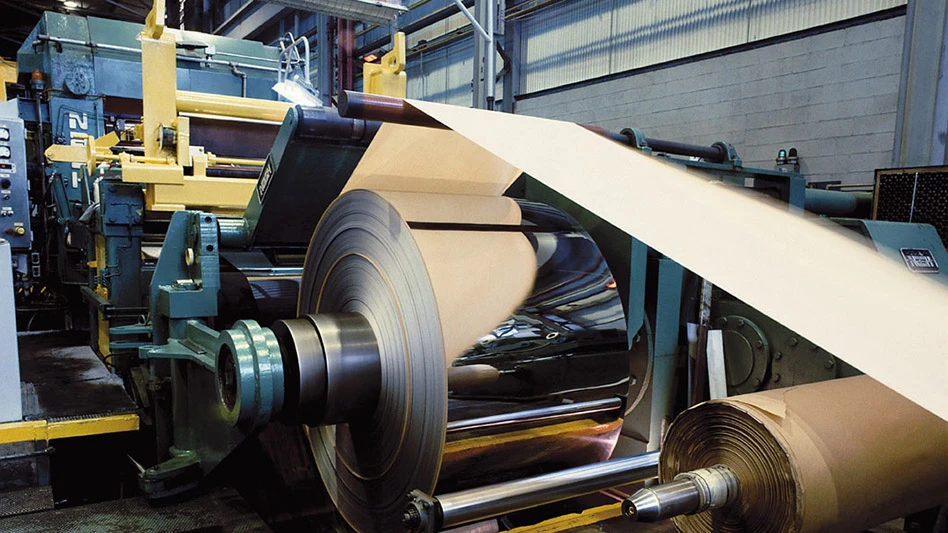

Photo courtesy of Cleveland-Cliffs Inc.

Cleveland-Cliffs Inc. is poised to benefit from moves it has made and the onshoring or reshoring of additional automative sector manufacturing activity, according to an analysis prepared by Tarrytown, New York-based bond rating agency Gimme Credit.

The analysis by Senior Bond Analyst Evan Mann says the Cleveland-based iron and steel producer, which also owns metals recycling firm Ferrous Processing & Trading, is beginning to benefit from higher volume steel shipments, an increase in averaging steel selling prices and lower operating costs.

Even in its money-losing second quarter, Mann says, “Results remained on track to continue improving from $300 million in expected run rate cost savings on the idling of facilities [and] $250 million to $500 million in expected run rate earnings before interest, taxes, depreciation and amortization [EBITDA] gains due to the onshoring of auto manufacturing (starting incrementally in the second half and continuing into 2026).”

As has Cliffs CEO Lourenco Goncalves, Gimme Credit points to the upcoming December cancellation of an unfavorable slab contract as a factor poised to improve the steelmaker’s bottom line. (Mann pegs that as a $125 million per quarter EBITDA benefit.)

The combination of factors, according to Mann, has Cleveland-Cliffs estimating it can boost its adjusted EBITDA run rate from $1.05 billion to $1.3 billion in 2026.

The analysis points to a 14 percent decline in auto-related revenue in this year’s second quarter, though saying that decline was partly offset by incremental tons sold related to last fall’s Stelco acquisition.

Gimme Credit says Cleveland-Cliffs ended the second quarter with $2.7 billion in liquidity and no bond maturity until 2029.

A series of financing maneuvers taken by the firm, along with improved pricing, are expected to support increased EBITDA as well as the continued release of working capital in the second half of the year, Mann says.

He says the potential asset (steel mill) sales being explored could accelerate debt reduction and face positive prospects in part because of “foreign entities looking to tap into the U.S. auto and electrical steel sectors.”

If the mill sites in Riverdale, Illinois, and in Steelton and Conshohocken, Pennsylvania, are not sold to fellow steel producers, Mann says they have attracted interest from data center developers “due to their proximity to water and power supplies.”

A variable in the optimistic scenario involves overall economic conditions, according to Mann.

“While we expect EBITDA gains to accelerate in the second half and into 2026, key risks to this outcome include weak auto demand and steel pricing, especially if the economy slows and labor market conditions weaken further,” he writes.

Latest from Recycling Today

- U.S. Aluminum Co. explores aluminum fabrication plant in Oklahoma

- Sonoco completes portfolio transformation

- Eriez Shred1 data demonstrates scalable copper control

- RCI selects CurbWaste as exclusive operational management platform

- Updated: Supreme Court strikes down IEEPA tariffs

- Recycling Today Media Group launches Scrap Expo Lunch & Learn Webinar Series

- LyondellBasell scales back recycling target

- Former Liberty UK mills eyed by 3 suitors