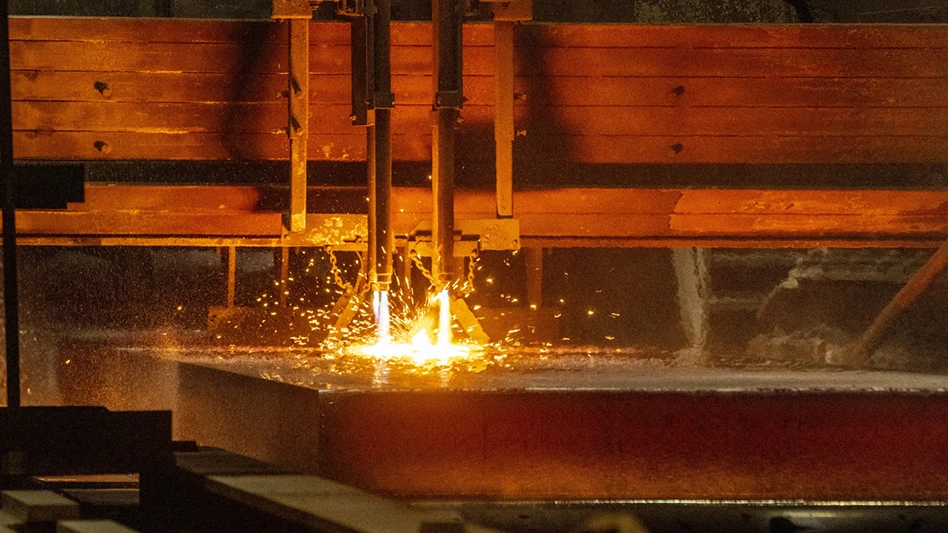

Photo courtesy of Cleveland-Cliffs Inc.

Cleveland-Cliffs Inc., which operates steel mills, iron production sites and the Ferrous Processing & Trading metals recycling firm, has reported third-quarter 2025 revenue that is lower than the previous quarter but a net loss figure that is smaller compared with the second quarter.

The Cleveland-based company has reported third-quarter 2025 revenue of $4.7 billion, down 4.1 percent compared with $4.9 billion of revenue in the prior quarter.

Cliffs experienced an adjusted net loss of $223 million, or 45 cents per diluted share, in this year’s third quarter compared with a second-quarter 2025 adjusted net loss of 51 cents per diluted share.

“Our third-quarter results marked a clear sign of demand recovery for automotive-grade steel made in the United States, and that is a direct consequence of the new trade environment implemented and enforced by the Trump administration,” Cliffs President and CEO Lourenco Goncalves says. “As a result of this new trade environment, we have won new and growing supply arrangements with all major automotive OEMs, locking in multiyear agreements that reflect the reliability of our well-established supply chains anchored by our nine galvanizing plants dedicated to automotive-grade steels.

“Our third-quarter results show a richer sales mix and improved pricing, further bolstered by our continued execution on costs. With the end of the slab supply contract to ArcelorMittal in early December, we expect this trend to accelerate into 2026.”

Goncalves also has disclosed that Cliffs is negotiating with an overseas steelmaker to sell or make available capacity at some of its idled mill sites and is working with global banking firm UBS as its financial advisor on the potential transaction.

“The U.S. is the most attractive steel market in the world,” he says. “For a foreign partner, the opportunity to participate in the U.S. market through Cliffs is incredibly valuable. This past quarter, we entered into a memorandum of understanding with a major global steel producer, which seeks to leverage our unmatched U.S. footprint and trade-compliant operations. We expect the ultimate outcome of this MoU to be highly accretive to our shareholders. We look forward to sharing more on this ongoing development soon.”

He also says in response to the potential need for the United States to ramp up its production of rare earth elements (REEs), Cliffs is exploring making suitable arrangements at its mining sites.

“The renewed importance of rare earths has driven us to refocus on this potential opportunity at our upstream mining assets,” Goncalves says. “We have looked at all of our ore bodies and tailings basins, and two sites in particular, one in Michigan and one in Minnesota, show the most potential.”

At those two sites, he says, the potential harvesting of REEs would align Cleveland-Cliffs with the broader national strategy for critical material independence, similar to what we achieved in steel.

"American manufacturing shouldn’t rely on China or any foreign nation for essential minerals, and Cliffs intends to be part of the solution," Goncalves says.

Latest from Recycling Today

- SSAB finishes 2025 with decreased revenue

- Vecoplan appoints CFO

- Aurubis raises full-year forecast

- Levitated Metals adds LIBS sorting technology

- Redwood Materials closes on $425M in Series E financing

- Updated: Wieland Chase expands northwest Ohio facility

- Recovered paper traders report lukewarm market

- SHFE trading expansion focuses on nickel