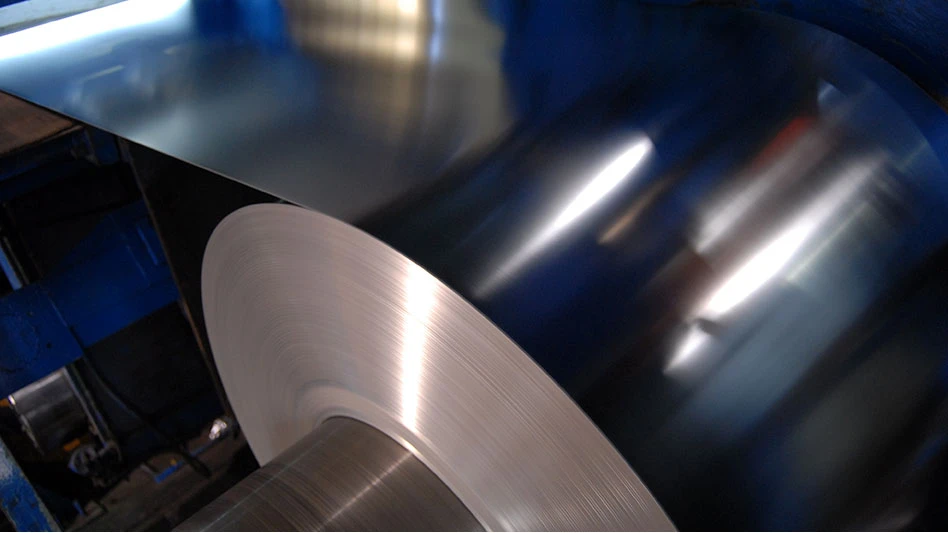

Photo courtesy of the former Altos Hornos de México

Steelmaking and raw materials mining sites once operated by Altos Hornos de México (AHMSA), a firm that went bankrupt earlier this decade, reportedly are attracting interest from buyers willing to bring the sites back to life at the end of the AHMSA liquidation process.

Reports list Luxembourg-based ArcelorMittal, Minneapolis-based Cargill Financial Services, Japan-based Nippon Steel Corp. and Mexico-based Villacero as companies that have expressed interest in the assets in the midst of liquidation.

AHMSA operated blast furnace/basic oxygen furnace mills in Mexico, while its Minera del Norte (MINOSA) business unit mined metallurgical coal to help supply those mills. According to the AHMSA website, MINOSA had the capacity to produce 4 million tons per year of coal, and its mills in Monclova, Mexico, could produce a roughly equivalent amount of steel.

“All companies were invited based on financial capacity and formal commitment, and several have already begun technical evaluations of the assets,” Paloma Duran writes in a report for Mexico Business Journal.

According to Duran, an auction for the assets could be held as soon as January 2026 for the portfolio of assets, which carries an estimated value of more than $1.3 billion.

According to a report by Muflih Hidayat for Discovery Alert, the steel-related assets for sale include the 4 million metric tons per year of melt shop capacity, rolling and finishing operations producing automotive and construction sector grades, quality control and testing laboratories, existing transportation and logistics infrastructure and environmental management systems that could require modernization investment.

AHMSA experienced financial woes and eventual bankruptcy because of its alleged ties to a bribery scandal.

Latest from Recycling Today

- Solarcycle’s Cedartown, Georgia, recycling facility opens

- Stadler equips Spanish MRF

- SSAB finishes 2025 with decreased revenue

- Vecoplan appoints CFO

- Aurubis raises full-year forecast

- Levitated Metals adds LIBS sorting technology

- Redwood Materials closes on $425M in Series E financing

- Updated: Wieland Chase expands northwest Ohio facility